sr22 coverage sr22 insure insurance coverage

sr22 coverage sr22 insure insurance coverage

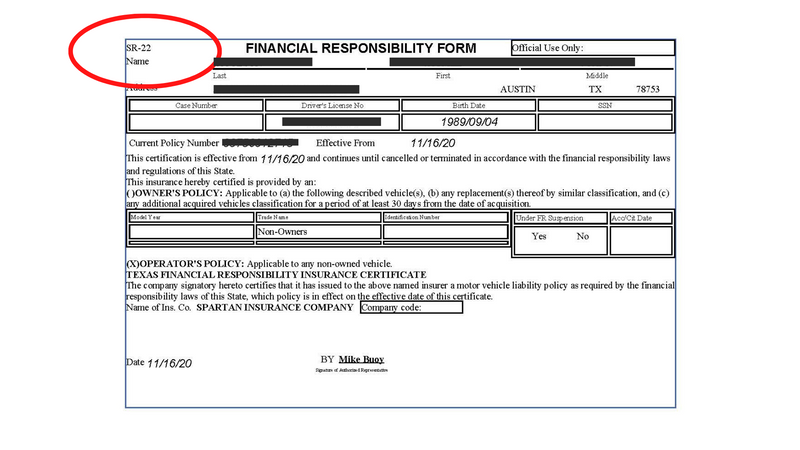

You should send the adhering to products to the Motorist License Bureau before completion of the suspension duration before your chauffeur certificate can be restored on the eligibility date: Evidence of responsibility insurance policy (copy of your insurance recognition card). sr-22. Proof of insurance need to be maintained for three years from the day you came to be qualified to be restored.

$200 if it is your 2nd crime. $400 if it is your 3rd or succeeding crime - car insurance. - If you have actually been put on hold since you were associated with an accident in an additional state and also you did not have any kind of insurance policy in effect at the time of the crash, you should send the adhering to things to the Driver License Bureau before you can be restored: Reinstatement or Clearance Letter from the state where you were associated with the accident.

The SR-22 filing is called for if you were originally put on hold due to the fact that of an automobile mishap - car insurance. Otherwise, you can submit proof of insurance policy by providing a duplicate of your insurance recognition card. insurance. Evidence of insurance policy must be kept for the remainder of the three-year duration that you were originally needed to keep an SR-22 declaring.

The SR-22 itself is a paper, sent by an insurance firm, guaranteeing that a motorist has the minimum required insurance policy in order to remain on the roadway - division of motor vehicles. Submitting an SR-22 in Montana appears complexbut it's not. Collaborating with your insurance coverage service provider, as well as using the help of vehicle insurance coverage and broker application Jerry, you could be back when traveling and also driving safely in a snap! Review on to locate out exactly just how SR-22s job in Montana.

Getting My Sr-22 And Insurance After Dwi - Travis Noble To Work

Essentially, it's a warranty that you're still safe to drive regardless of whatever policy you may have breached. In the majority of situations, Montana requests an SR-22 after your certificate has actually been suspended or revoked - sr-22. You'll typically need to have SR-22 insurance policy for 3 years following a major occurrence, which can include however are not restricted to: Negligent driving, Struck as well as run, DUIDriving without insurance Tallying way too many bad mark factors on your permit If you're founded guilty of one of those, you'll need your insurance firm to assure minimum responsibility protection.

Trick Takeaway you'll require an SR-22 for three years after having your permit revoked or put on hold in Montana. Vehicle drivers that have dedicated a serious driving offense, or selected up also lots of points on their certificate will need SR-22 insurance policy in Montana.

Just how much does an SR-22 price in Montana? The majority of insurance companies bill a small charge of $15-25. The exact number depends on the state and also the service provider. Nonetheless, there are other expenses to remember. Some states ask for costly motorist's permit reinstatement feessometimes more than $100. Furthermore, there are penalties and also legal costs that could come with a conviction for a criminal infraction. insurance.

insurance coverage driver's license driver's license coverage liability insurance

insurance coverage driver's license driver's license coverage liability insurance

Eventually, SR-22 insurance policy is pricey. Just how does an SR-22 influence your insurance coverage in Montana?

Fascination About What Is Sr-22 Insurance And Who Needs It? - Credit Karma

As well as the other reasons for requiring an SR-22, such as racking up way too many bad mark points, do not look as well terrific either. It's great that your insurer could be able to obtain you back behind a wheel, but it'll come with a substantial costs increase - insurance coverage. The specific number will certainly vary, but some states see a walk of up to 50% or more. car insurance.

liability insurance motor vehicle safety coverage sr22 coverage sr-22 insurance

liability insurance motor vehicle safety coverage sr22 coverage sr-22 insurance

How to discover low-cost cars and truck insurance SR-22s aren't fantastic for your driving record or savings account. vehicle insurance. But they're not the end of the globe. You can still locate a great cars and truck Click here for more insurance coverage bundle at a cost that suits you. To find the best bargain, try Jerry. An accredited broker, Jerry does all the effort of locating the cheapest quotes from the leading insurance provider as well as buying brand-new cars and truck insurance coverage.

And to ensure you always have the least expensive price, Jerry will certainly send you brand-new quotes whenever your plan turns up for renewal, so you're always getting the protection you desire at the very best cost. This degree of service is why Jerry earned a 4 - motor vehicle safety. 6/5 ranking on the App Store and also made it the leading insurance coverage app in the nation. division of motor vehicles.

insurance companies dui motor vehicle safety insurance deductibles

insurance companies dui motor vehicle safety insurance deductibles

Part of me still seems like it's as well great to be true. They saved me OVER $100 a MONTH. I've constantly battled with searching for affordable insurance coverage. I have a clean record, yet my insurance policy was rising and up. They matched my existing insurance and also obtained me a price that virtually made me weep - dui.

The Buzz on Sr-22 Insurance Requirement - Dui Defense In Washington ...

car insurance insurance coverage bureau of motor vehicles bureau of motor vehicles dui

car insurance insurance coverage bureau of motor vehicles bureau of motor vehicles dui

If you remain in difficulty in California due to being without insurance in an accident or getting a DUI, you could be needed to confirm you have auto insurance policy with a kind called an SR-22. sr-22. An SR-22 is a certification, called a California Insurance Coverage Evidence Certificate, that your insurance company data with the California Division of Electric Motor Cars. insurance group.

See what you can minimize auto insurance, Easily contrast tailored rates to see just how much changing car insurance can conserve you. If you do not get an SR-22 after a severe offense, you could lose your driving advantages. Below's why you might need one and also just how to discover the least expensive insurance policy rates if you do. dui.

Exactly how to get an SR-22 in California, Submitting an SR-22 isn't something you do on your own. California needs insurance firms to digitally report insurance details to the DMV.If you require an SR-22, ask your insurer to file one on your behalf if it will (division of motor vehicles). Some insurance policy firms do not submit SR-22s.